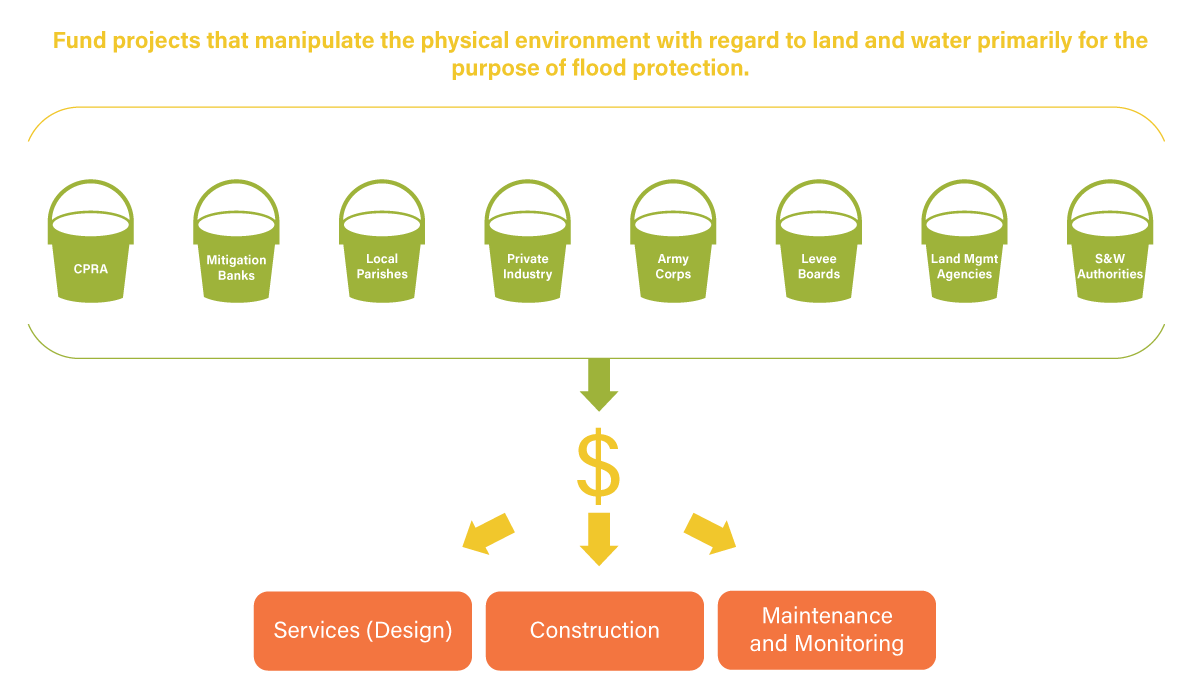

The CPRA develops and implements the state's Coastal Master Plan, but the CPRA does not lead every coastal restoration and flood protection project in the Master Plan. The CPRA actually allocates to partner agencies the money and authority to lead many master plan projects. For the projects that the CPRA leads itself, the CPRA executes construction and services contracts. The totals below include payments made through purchase orders over the course of a fiscal year (not the total value of active contracts during the fiscal year, some of which may span multiple years).

Construction contracts go through a state open-bid process through which the lowest bid is selected, according to state law. Services contracts are entirely different from construction contracts. CPRA issues Requests for Proposals (RFPs) or Requests for Statement of Interest and Qualifications (RSIQs) for certain regular services about every 18 to 24 months. For each RFP/RSIQ, multiple companies are selected for a contract, generally, for a 3-year period. The contract is Indefinite Delivery Indefinite Quantity (IDIQ) with a maximum starting contract value generally ranging from $1 to $5 million, depending upon the service. An IDIQ contract is one that allows for task orders to be issued as work is needed by CPRA. At any given time, CPRA typically has 30-50 active IDIQs.

In addition to the construction and regular services payments shown in the charts below, the CPRA also contracts with other government partners (including federal agencies, local governments, and levee districts) to lead master plan projects, and contracts with universities, nonprofits, and private businesses to provide additional services. In total, payments on these other types of contracts exceeded $500 million during fiscal years 2018-2023.